-

News

Aurelius Reports Final Drill Results From Phase 2 Program at Aureus East; Resource Update Expected by early Q2 2022

February 22, 2022

Highlights from Aureus East underground and surface drilling include:

- Multiple high-grade intersections including 73.4 grams per tonne gold ("g/t Au”) over 0.65 metres (“m”), 65.9 g/t Au over 0.95m, 56.2 g/t Au over 0.55m, 46.7 g/t Au over 1.00m and 20.8 g/t Au over 1.60m;

- 100% of the Phase 2 drill holes successfully intersected gold mineralization;

- Gold mineralization continues to expand along strike, in width, at depth and remains open in all directions; and

- With Phase 2 drilling and assay results complete at Aureus East, an updated mineral resource estimate is expected by April 2022.

Toronto, ON – Aurelius Minerals Inc. (TSX.V: AUL) (OTCQB: AURQF) (the “Company” or “Aurelius”) is pleased to report the final of high-grade results from its flagship Aureus East Gold Project in Nova Scotia, Canada from six drill holes and two wedge holes. The Company is drilling at the Aureus East Project to define a new gold mineral resource (expected early in the second quarter) and continues to expand mineralization upon the success of the Phase 1 and Phase 2 program results. The results reported today were from four underground holes, two surface holes and two wedge holes. Mineralization was expanded into the limb system, laterally to the north and south and at depth, resulting in continued identification of previously overlooked gold horizons.

Aurelius’ President and CEO, Mark N.J. Ashcroft, P.Eng said, “We are extremely excited by the grades and lengths we are seeing in our assays, as they continue to demonstrate the potential to expand mineralization beyond what was originally thought as our interpretation of the geology continues to evolve. Today’s drill results demonstrate the strong continuity along strike, allowing for an expansion of the gold zones to the east, laterally to the north and south and at depth. I am very pleased with the success achieved by our exploration team.”

Aurelius’ Vice President, Exploration, Jeremy Niemi, P.Geo, stated, “Based on our success in Hole AE-21-48, we added two wedge holes from that parent hole, which allowed us to save re-drilling from the top of the hole and to target mineralization below 400m depth. Utilizing wedging saves on metres for deeper targets and adds value to the program, while enhancing our interpretation of the lower portions of the deposit. Step-outs from wedges refine our understanding in the newly drilled area and enhance our interpretation of the resource model. Limbs of the gold horizons have expanded to the north and south of the saddle, which occurs along the axis of the anticline controlling the gold mineralization.”

“Gold mineralization continues to expand at depth and remains open. In the first two phases of our program, we completed 49 holes, along with two wedge holes, with a 100% success rate of intersecting mineralization. In Phase 2 of our drill program, we completed more than 12,000m of drilling and with all of these drill results from Aureus East now back from the lab, we anticipate the final interpretation of results and their incorporation into the updated mineral resource estimate within the next six to eight weeks.”

Figure 1: Core photo showing multiple occurrences of visible gold in drill core from AE-21-047 at a depth of 176.70m – 0.8m sample graded 19.4 g/t Au.

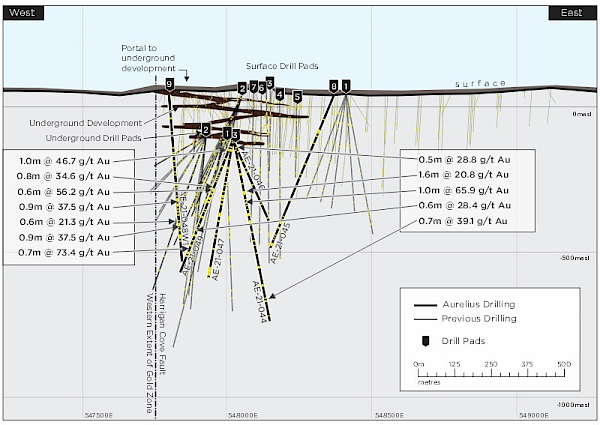

Figure 2. Longitudinal section of the Aureus East Gold Project, showing released holes and pad locations, and highlights of intersections exceeding >20 g/t Au.

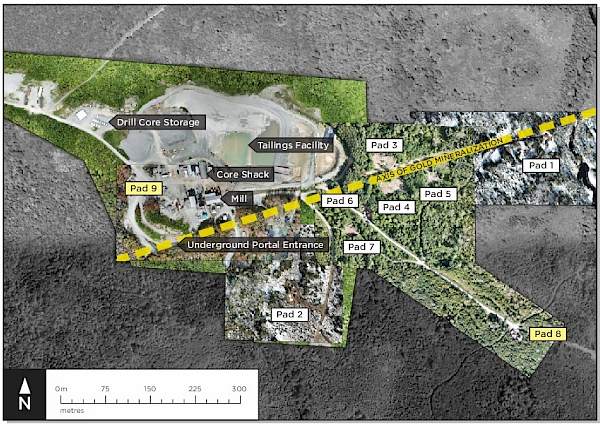

Figure 3. Plan view of Aureus East Gold Project surface infrastructure and pad locations over compiled drone imagery from 2021.

Update on Current and Upcoming On-site Activities

Having completed Phase 2 drilling at Aureus East, the near-term focus has shifted to a recently initiated underground channel sampling and mapping program. Aurelius believes there is considerable opportunity to identify continuous mineralization directly adjacent to the existing underground development infrastructure. Channel sampling in the underground drifts, where saddle reefs are exposed, will be the priority in this area. The sampling program includes the walls and floor in multiple gold zones, which already contain known gold mineralization, and its results will be incorporated into the geological interpretation of the gold zones as part of the upcoming mineral resource estimate for Aureus East. Nordmin Engineering has been retained to prepare the updated mineral resource estimate, expected by early in the second quarter of 2022.

Regarding the Aureus East Project, the Ministry of Environment and Climate Change has directed the Company that it will require the completion of a Class 1 environmental assessment (“Class 1 EA”) to review the proposed reopening, and expansion, of the Aureus East Gold Project. The Company will engage in the process of completing the Class 1 EA in conjunction with the release of the updated mineral resource estimate and a preliminary economic assessment.

Table 1. Highlights from remaining holes of Phase 2 drill program at Aureus East.

Pad Hole ID

From (m)

To (m)

Length (m)

Au g/t

S8

AE-21-045

333.95

334.70

0.75

4.01

S8

AE-21-045

427.60

428.40

0.80

5.38

S9

AE-21-048

207.85

208.80

0.95

10.5

S9

AE-21-048

403.20

404.10

0.90

37.5

S9

AE-21-048

494.30

495.65

1.35

9.67

S9

including

495.10

495.65

0.55

21.3

W

AE-21-048W1

441.50

442.00

0.50

10.6

W

AE-21-048W2

481.55

484.40

2.85

5.40

W

including

483.60

484.40

0.80

17.2

W

AE-21-048W2

505.75

506.65

0.90

27.9

UG3

AE-21-044

22.00

38.00

16.00

2.01

UG3

including

22.00

22.50

0.50

28.8

UG3

AE-21-044

177.75

190.00

12.25

3.41

UG3

including

177.75

183.00

5.25

6.97

UG3

including

177.75

179.35

1.60

20.8

UG3

AE-21-044

205.45

207.30

1.85

34.2

UG3

including

205.45

206.40

0.95

65.9

UG3

AE-21-047

32.10

34.75

2.65

18.4

UG3

including

32.10

33.10

1.00

46.7

UG3

AE-21-047

254.50

266.45

11.95

2.07

UG3

including

254.50

258.20

3.70

4.92

UG3

including

257.25

258.20

0.95

17.1

UG3

AE-21-049

176.70

232.90

56.20

1.53

UG3

including

176.70

198.00

21.30

3.49

UG3

including

176.70

177.50

0.80

34.6

UG3

including

179.20

187.00

7.80

5.02

UG3

including

179.20

179.75

0.55

56.2

UG3

AE-21-049

332.00

360.00

28.00

2.51

UG3

including

332.00

343.70

11.70

3.70

UG3

including

332.00

332.60

0.60

28.4

UG3

including

342.75

343.70

0.95

18.0

UG3

including

350.10

351.40

1.30

13.3

UG3

including

356.50

358.00

1.50

5.33

UG3

AE-21-049

394.00

396.40

2.40

20.7

UG3

including

395.75

396.40

0.65

73.4

Table 2. Hole location, final depth and orientation for reported holes.

Pad

Hole ID

Easting

Northing

Length

Azimuth

Dip

Wedge Start Depth

AE UG3

AE-21-044

548018

4979937

645

100

-77

AE S8

AE-21-045

548368

4979751

651

315

-60

AE UG3

AE-21-046

548019

4979937

306

95

-65

AE UG3

AE-21-047

548015

4979937

495

235

-76

AE S9

AE-21-048

547794

4979963

648

165

-74.5

Wedge*

AE-21-048W1

547794

4979963

182

165

-70

403

Wedge*

AE-21-048W2

547794

4979963

300

163

-71

216.4

AE UG3

AE-21-049

548015

4979937

507

245

-65

*Note: Holes AE-21-48W1 and AE-21-48W2 utilized a downhole wedge within AE-21-48 and share the collar location and the start depth down hole AE-21-48 is indicated in the table above.

Table 3. Reported intervals from underground drilling at Aureus East Gold Project.

Pad

Hole ID

From (m)

To (m)

Length (m)

Au g/t

UG3

AE-21-044

0.00

1.59

1.59

0.71

UG3

AE-21-044

2.88

3.50

0.62

3.14

UG3

AE-21-044

22.00

38.00

16.00

2.01

UG3

including

22.00

22.50

0.50

28.8

UG3

including

30.00

30.50

0.50

4.17

UG3

including

33.10

36.00

2.90

4.33

UG3

AE-21-044

65.80

67.50

1.70

1.31

UG3

AE-21-044

113.50

117.00

3.50

0.74

UG3

AE-21-044

149.00

149.80

0.80

3.00

UG3

AE-21-044

177.75

190.00

12.25

3.41

UG3

including

177.75

183.00

5.25

6.97

UG3

including

177.75

179.35

1.60

20.8

UG3

including

185.00

190.00

5.00

1.02

UG3

AE-21-044

205.45

207.30

1.85

34.2

UG3

including

205.45

206.40

0.95

65.9

UG3

AE-21-044

216.00

220.20

4.20

0.50

UG3

AE-21-044

228.75

229.50

0.75

0.75

UG3

AE-21-044

241.80

242.80

1.00

0.71

UG3

AE-21-044

254.85

257.35

2.50

0.54

UG3

AE-21-044

263.65

264.60

0.95

1.20

UG3

AE-21-044

282.40

283.08

0.68

0.73

UG3

AE-21-044

285.18

287.00

1.82

0.77

UG3

AE-21-044

291.40

295.50

4.10

3.72

UG3

including

291.40

292.40

1.00

5.83

UG3

including

294.50

295.50

1.00

8.24

UG3

AE-21-044

321.10

321.90

0.80

5.51

UG3

AE-21-044

338.50

339.10

0.60

0.52

UG3

AE-21-044

351.00

352.85

1.85

0.64

UG3

AE-21-044

369.50

370.20

0.70

5.40

UG3

AE-21-044

396.00

399.37

3.37

0.71

UG3

AE-21-044

443.50

444.00

0.50

3.20

UG3

AE-21-044

448.80

449.80

1.00

0.76

UG3

AE-21-044

470.00

471.00

1.00

0.59

UG3

AE-21-044

507.50

515.50

8.00

1.23

UG3

including

507.50

508.13

0.63

8.61

UG3

AE-21-044

557.10

557.80

0.70

39.1

UG3

AE-21-044

564.50

570.00

5.50

3.40

UG3

including

569.15

570.00

0.85

18.4

UG3

AE-21-044

620.00

621.00

1.00

2.53

UG3

AE-21-046

2.80

3.60

0.80

0.8

UG3

AE-21-046

38.00

38.50

0.50

0.85

UG3

AE-21-046

43.50

44.30

0.80

0.55

UG3

AE-21-046

75.13

77.00

1.87

0.88

UG3

AE-21-046

100.85

102.15

1.30

5.24

UG3

including

100.85

101.50

0.65

9.84

UG3

AE-21-046

118.00

119.00

1.00

1.00

UG3

AE-21-046

163.00

164.00

1.00

4.45

UG3

AE-21-046

240.00

240.80

0.80

4.26

UG3

AE-21-046

292.20

293.00

0.80

6.96

UG3

AE-21-047

27.60

28.40

0.80

1.07

UG3

AE-21-047

32.10

34.75

2.65

18.4

UG3

including

32.10

33.10

1.00

46.7

UG3

AE-21-047

62.60

64.60

2.00

1.53

UG3

AE-21-047

89.55

93.10

3.55

1.35

UG3

AE-21-047

97.00

98.65

1.65

0.69

UG3

AE-21-047

110.65

111.50

0.85

4.18

UG3

AE-21-047

123.40

125.10

1.70

0.84

UG3

AE-21-047

144.40

146.00

1.60

2.14

UG3

AE-21-047

176.70

180.00

3.30

5.71

UG3

including

176.70

177.50

0.80

19.4

UG3

AE-21-047

191.70

192.70

1.00

0.82

UG3

AE-21-047

197.00

201.10

4.10

0.96

UG3

AE-21-047

206.00

207.75

1.75

0.67

UG3

AE-21-047

209.35

210.25

0.90

1.13

UG3

AE-21-047

225.00

226.50

1.50

0.67

UG3

AE-21-047

254.50

266.45

11.95

2.07

UG3

including

254.50

258.20

3.70

4.92

UG3

including

257.25

258.20

0.95

17.1

UG3

including

265.55

266.45

0.90

5.68

UG3

AE-21-047

281.50

286.00

4.50

3.72

UG3

including

281.50

282.63

1.13

12.4

UG3

AE-21-047

292.30

293.00

0.70

3.30

UG3

AE-21-047

309.00

310.65

1.65

11.4

UG3

AE-21-047

329.65

330.20

0.55

6.04

UG3

AE-21-047

380.65

385.70

5.05

3.01

UG3

including

383.40

384.70

1.30

8.65

UG3

AE-21-047

449.00

477.60

28.60

0.72

UG3

including

449.73

450.60

0.87

7.71

UG3

AE-21-047

486.00

487.50

1.50

6.26

UG3

AE-21-049

2.00

2.50

0.50

2.55

UG3

AE-21-049

21.25

21.80

0.55

7.95

UG3

AE-21-049

22.50

24.00

1.50

1.16

UG3

AE-21-049

31.00

33.80

2.80

2.35

UG3

including

32.00

32.80

0.80

4.84

UG3

AE-21-049

65.80

67.20

1.40

0.69

UG3

AE-21-049

93.15

93.85

0.70

0.72

UG3

AE-21-049

95.35

96.25

0.90

0.98

UG3

AE-21-049

116.10

116.85

0.75

0.68

UG3

AE-21-049

128.50

129.30

0.80

2.19

UG3

AE-21-049

137.50

138.30

0.80

1.38

UG3

AE-21-049

145.25

146.80

1.55

0.65

UG3

AE-21-049

151.40

152.30

0.90

3.63

UG3

AE-21-049

176.70

232.90

56.20

1.53

UG3

including

176.70

198.00

21.30

3.49

UG3

including

176.70

177.50

0.80

34.6

UG3

including

179.20

187.00

7.80

5.02

UG3

including

179.20

179.75

0.55

56.2

UG3

including

197.00

198.00

1.00

4.85

UG3

including

205.00

205.70

0.70

3.72

UG3

AE-21-049

257.45

258.75

1.30

2.99

UG3

AE-21-049

265.50

266.15

0.65

4.69

UG3

AE-21-049

283.65

286.35

2.70

1.68

UG3

including

283.65

284.25

0.60

5.68

UG3

AE-21-049

290.00

291.00

1.00

0.68

UG3

AE-21-049

325.50

326.25

0.75

1.47

UG3

AE-21-049

332.00

360.00

28.00

2.51

UG3

including

332.00

343.70

11.70

3.70

UG3

including

332.00

332.60

0.60

28.4

UG3

including

342.75

343.70

0.95

18.0

UG3

including

350.10

351.40

1.30

13.3

UG3

including

356.50

358.00

1.50

5.33

UG3

AE-21-049

376.45

377.10

0.65

0.63

UG3

AE-21-049

378.40

380.00

1.60

0.86

UG3

AE-21-049

390.20

391.00

0.80

0.76

UG3

AE-21-049

394.00

396.40

2.40

20.7

UG3

including

395.75

396.40

0.65

73.4

UG3

AE-21-049

415.50

418.15

2.65

0.91

UG3

AE-21-049

423.00

424.00

1.00

0.67

UG3

AE-21-049

433.00

437.00

4.00

0.99

Table 4. Reported intervals from surface drilling at Aureus East Gold Project.

Pad

Hole ID

From (m)

To (m)

Length (m)

Au g/t

S8

AE-21-045

153.35

154.35

1.00

0.69

S8

AE-21-045

158.20

159.20

1.00

0.88

S8

AE-21-045

316.25

317.20

0.95

0.73

S8

AE-21-045

333.95

334.70

0.75

4.01

S8

AE-21-045

427.60

428.40

0.80

5.38

S8

AE-21-045

511.90

512.75

0.85

0.53

S8

AE-21-045

524.30

525.15

0.85

1.47

S8

AE-21-045

533.45

536.70

3.25

0.60

S8

AE-21-045

548.60

549.40

0.80

3.37

S8

AE-21-045

583.20

583.70

0.50

1.67

S8

AE-21-045

591.00

592.70

1.70

0.79

S8

AE-21-045

619.15

620.10

0.95

0.70

S8

AE-21-045

633.35

634.30

0.95

1.06

S9

AE-21-048

102.40

103.15

0.75

4.78

S9

AE-21-048

147.50

148.15

0.65

0.53

S9

AE-21-048

180.10

180.90

0.80

2.12

S9

AE-21-048

207.85

208.80

0.95

10.5

S9

AE-21-048

256.00

257.60

1.60

0.69

S9

AE-21-048

307.55

308.55

1.00

0.54

S9

AE-21-048

335.80

337.55

1.75

2.83

S9

AE-21-048

350.25

351.10

0.85

1.34

S9

AE-21-048

362.60

363.60

1.00

1.58

S9

AE-21-048

370.25

373.00

2.75

0.52

S9

AE-21-048

403.20

404.10

0.90

37.5

S9

AE-21-048

410.50

414.00

3.50

0.69

S9

including

411.35

412.10

0.75

1.51

S9

AE-21-048

420.45

421.35

0.90

1.81

S9

AE-21-048

442.90

443.60

0.70

1.43

S9

AE-21-048

453.04

454.00

0.96

1.58

S9

AE-21-048

467.03

467.65

0.62

1.42

S9

AE-21-048

477.00

477.75

0.75

6.49

S9

AE-21-048

494.30

495.65

1.35

9.67

S9

including

495.10

495.65

0.55

21.3

S9

AE-21-048

523.95

524.55

0.60

0.69

S9

AE-21-048

537.90

539.60

1.70

1.12

W

AE-21-048W1

412.00

413.45

1.45

0.70

W

AE-21-048W1

414.00

415.00

1.00

0.87

W

AE-21-048W1

441.50

442.00

0.50

10.6

W

AE-21-048W1

485.00

492.50

7.50

0.50

W

including

485.50

486.00

0.50

1.86

W

AE-21-048W1

509.25

511.70

2.45

1.13

W

including

510.75

511.70

0.95

2.20

W

AE-21-048W1

529.00

530.00

1.00

0.76

W

AE-21-048W1

535.75

536.50

0.75

0.54

W

AE-21-048W1

550.60

551.60

1.00

0.73

W

AE-21-048W2

225.55

226.15

0.60

0.53

W

AE-21-048W2

230.70

231.50

0.80

1.65

W

AE-21-048W2

253.95

255.50

1.55

0.60

W

AE-21-048W2

266.00

266.60

0.60

0.82

W

AE-21-048W2

297.75

298.50

0.75

1.87

W

AE-21-048W2

344.00

345.00

1.00

0.57

W

AE-21-048W2

349.00

350.00

1.00

1.93

W

AE-21-048W2

386.95

387.70

0.75

3.41

W

AE-21-048W2

396.65

397.35

0.70

6.24

W

AE-21-048W2

423.90

424.80

0.90

2.53

W

AE-21-048W2

427.15

428.00

0.85

0.89

W

AE-21-048W2

440.20

440.75

0.55

4.76

W

AE-21-048W2

451.00

451.75

0.75

1.53

W

AE-21-048W2

455.80

456.50

0.70

2.93

W

AE-21-048W2

463.40

464.00

0.60

0.74

W

AE-21-048W2

481.55

484.40

2.85

5.40

W

including

483.60

484.40

0.80

17.2

W

AE-21-048W2

505.75

506.65

0.90

27.9

Note: Due to the folded geometry of the gold horizons the intervals may not represent true width.

COVID-19 Precautions

Aurelius has developed and implemented compliant precautions and procedures that are in line with guidelines for the Province of Nova Scotia. Protocols were put in place and are updated where necessary to ensure the safety of our employees, contractors and the communities in which we operate.

Qualified Person and Analytical Procedures

Mr. Jeremy Niemi, P.Geo. and Vice President, Exploration of Aurelius and the Company’s Qualified Person as defined by NI 43-101, has reviewed and approved the technical information in this release.

Individual drill core samples are labeled, placed in plastic sample bags and sealed. Groups of samples are then placed into durable rice bags and then shipped by courier for analyses to ALS Geochemistry, Moncton, New Brunswick. Sample preparation occurs at ALS in Moncton where samples are weighed, dried, crushing one kilogram to 70 percent less than two millimeters and then pulverized to create a one-kilogram sample with 85 percent less than seventy-five microns. Potential high-grade gold samples are sent for metallic screen fire assay and remaining material is assayed for 50-gram fire assay and samples grading more than 100 parts per million have a gravimetric finish performed. When visible gold is encountered the Company samples both halves of the core. The remaining coarse reject portions of the samples remain in storage if further work or verification is needed. The Company inserted control samples (accredited gold standards, blanks and duplicates) at least every 20 samples and monitors the control samples inserted by ALS.

About Aurelius

Aurelius is a well-positioned gold exploration company focused on advancing its recently acquired and renamed Aureus Gold Properties, including Aureus East and West, the Tangier Gold Project and the Forest Hill Gold Project located in Nova Scotia and described in detail in the Company’s press release of November 18, 2019.

Aurelius is also focused on advancing two district-scale gold projects in the Abitibi Greenstone Belt in Ontario, Canada, one of the world’s most prolific mining districts; the 968-hectare Mikwam Property, in the Burntbush area on the Casa Berardi trend and the 12,425-hectare Lipton Property, on the Lower Detour Trend.

The Company has a management team with experience in all facets of the mineral exploration and mining industry who will be considering additional acquisitions of advanced staged opportunities in Nova Scotia, the Abitibi and other proven mining districts.

On Behalf of the Board

AURELIUS MINERALS INC.For further information please contact:

Aurelius Minerals Inc.

Mark N.J. Ashcroft, P.Eng., President and CEO

info@aureliusminerals.com

Tel.: (416) 304-9095

www.aureliusminerals.comNeither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Information

This news release contains “forward-looking information” under the provisions of applicable Canadian securities legislation, concerning the business, operations and financial performance and condition of Aurelius. All statements in this press release, other than statements of historical fact, are “forward-looking information” with respect to Aurelius within the meaning of applicable securities laws, including statements with respect to the Company’s planned drilling and exploration activities, the anticipated benefits of the Acquisition and the development of the Aureus Gold Properties, the future price of gold, the estimation of Mineral Resources, the realization of Mineral Resource estimates, success of exploration activities, permitting time lines, currency exchange rate fluctuations, requirements for additional capital, government regulation of mining operations, environmental risks, unanticipated reclamation expenses, title disputes or claims and limitations on insurance coverage. Generally, this forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" , "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" , "believes", or variations or comparable language of such words and phrases or statements that certain actions, events or results "may", "could", "would", "should", "might" or "will be taken", "occur" or "be achieved" or the negative connotation thereof. Forward-looking information is necessarily based upon a number of factors and assumptions that, if untrue, could cause the actual results, performances or achievements of Aurelius to be materially different from future results, performances or achievements expressed or implied by such statements. Such statements and information are based on numerous assumptions regarding present and future business strategies and the environment in which Aurelius will operate in the future, including the price of gold, anticipated costs and ability to achieve goals.

Certain important factors that could cause actual results, performances or achievements to differ materially from those in the forward-looking information include, among others, gold price volatility, mining operational and development risks, litigation risks, regulatory restrictions (including environmental regulatory restrictions and liability), changes in national and local government legislation, taxation, controls or regulations and/or change in the administration of laws, policies and practices, expropriation or nationalization of property and political or economic developments in Canada, delays, suspension and technical challenges associated with projects, higher prices for fuel, steel, power, labour and other consumables, currency fluctuations, the speculative nature of gold exploration, the global economic climate, dilution, share price volatility, competition, loss of key employees, additional funding requirements and defective title to mineral claims or property. Although Aurelius believes its expectations are based upon reasonable assumptions and has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the Mineral Resources will be converted to Mineral Reserves. Inferred Mineral Resources are based on limited drilling which suggests the greatest uncertainty for a resource estimate and that geological continuity is only implied. Additional drilling will be required to verify geological and mineralization continuity and it is reasonable that most of the Inferred Mineral resources could be upgraded to Indicated Mineral Resources.

The Company provides forward-looking information for the purpose of conveying information about current expectations and plans relating to the future and readers are cautioned that such statements may not be appropriate for other purposes. By its nature, this information is subject to known and unknown risks, uncertainties and other important factors that may cause the actual results, level of activity, performance or achievements of Aurelius to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: risks related to difficulties in executing exploration programs at the Mikwam, Lipton and Aureus Gold Properties on the Company’s proposed schedules and within its cost and scheduling estimates, whether due to weather conditions, availability or interruption of power supply, mechanical equipment performance problems, natural disasters or pandemics in the areas where it operates, the integration of acquisition; risks related to current global financial conditions including market reaction to the coronavirus outbreak; competition within the industry; actual results of current exploration activities; environmental risks; changes in project parameters as plans continue to be refined; future price of gold; failure of plant, equipment or processes to operate as anticipated; mine development and operating risks; accidents, labour disputes and other risks of the mining industry; delays in obtaining approvals or financing; risks related to indebtedness and the service of such indebtedness, as well as those factors, risks and uncertainties identified and reported in Aurelius’ public filings under Aurelius’ SEDAR profile at www.sedar.com. Although Aurelius has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements are made as of the date hereof and, accordingly, are subject to change after such date. Aurelius disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise unless required by law.

Subscribe for UpdatesRegister to receive news via email from Aurelius Minerals Inc.

* Required Fields- Home

- Corporate

- Investors

- Projects

- News

- Contact

© 2025 Aurelius Minerals Inc.

All rights reserved.