-

News

Aurelius Announces Maiden Mineral Resource Estimate at Aureus East

May 26, 2022

Significant Milestone to Enhanced Value Creation

Toronto, ON - Aurelius Minerals Inc. (TSX.V: AUL) (OTCQB: AURQF) (the “Company” or “Aurelius”) is pleased to announce its maiden Mineral Resource Estimate (“MRE”) for the 100% owned Aureus East Gold Project, with 162,700 ounces (“oz”) Indicated gold (“Au”) and 387,600 oz Inferred Au contained in the consolidated MRE.

Highlights of the Aureus East gold MRE include:

- Combined Indicated Mineral Resources of 162,700 oz Au, including;

- 78,000 oz Au pit constrained Indicated Mineral Resource; and

- 84,700 oz Au underground constrained Indicated Mineral Resource.

- Combined Inferred Mineral Resources of 387,600 oz Au, including;

- 147,200 oz Au pit constrained Inferred Mineral Resource; and

- 240,400 oz Au underground constrained Inferred Mineral Resource.

- Tremendous exploration potential remains:

- Multiple zones north and south of the axis of the deposit

- Zones extend from surface, open at depth

- Potential for surface extraction and near surface resource growth

- Majority of drilling is less than 500m depth and constrained to western portion of the deposit

- Mineral resource estimate de-risks the Aureus East Project and advances value creation strategy

Aurelius CEO, Mark N.J. Ashcroft, P.Eng, said, “Delivery of our maiden MRE at Aureus East is a major milestone for the Company. We established this maiden resource estimate as a key milestone for the project, and we have delivered on that in 21 months. We had exceptional success in validating the Project's potential, with our drill program intersecting significant intervals of gold at 100% of our drill holes. The result is a robust gold resource that unlocks tremendous value through the drill bit and demonstrates the potential for significant additional resource growth in the near term. With this resource now in hand, we are well positioned to advance our value creation strategy by focusing on expanding this resource further with Phase 3 drilling, followed by the initiation of a Preliminary Economic Assessment (“PEA”) Study. We would like to thank the entire Aurelius team, including our contractors and local communities, for their commitment and contribution to this achievement.”

“This MRE represents an exciting milestone for the Aureus East Project and confirms the abundant gold mineralization intersected in our first two phases of drilling. The majority of the drilling to date is less than 500m in depth and constrained to the western portion of the project. We believe there is strong potential to expand the resource at depth, as all zones appear to continue along strike for at least 1600m. As well, most of the deposit remains underexplored and there is a good opportunity to grow the resource by following the zones to the east. Going forward, we will be looking to incorporate the results of the recently completed channel sampling program into the resource estimate, as well as enhance it through targeting high grade zones in the next phase of our exploration drilling. We are delighted at the pace of advancement of the project,” said Jeremy Niemi, P.Geo., Vice President, Exploration.

Outlook

The MRE represents an important building block in delivering on the Company’s “Define/Refine/Re-Engineer” value creation strategy, as it demonstrates management’s successful interpretation of the deposit. The robustness of the MRE provides both an increased understanding and flexibility to the management team, as it further evaluates pathways to enhanced value creation at Aureus East, whether leveraging existing mill infrastructure and assets or focusing on a potential hub and spoke model collaboration with other operations. Nova Scotia’s growing gold mining belt includes a producing mine and multiple advanced deposits within a 100km radius of the Aureus East Project, providing opportunities to enhance value within a mining-friendly jurisdiction.

Aurelius now has four distinct mineral resource estimates in Nova Scotia, with a strong potential for resource growth at each deposit. All deposits extend from surface and are open at depth.

Next Steps

The Company intends to build on the success of the MRE by focusing the next phases of drilling on high grade target zones (i.e., Zone 4 – 944 Level channel sampling) in an effort to increase the resource estimate in the near term and advance the project towards a PEA. Aureus East remains open at depth and most of the drilling to date has focused on the first 500m of strike from the western limit of the deposit. As a result, most of the deposit is underexplored at this stage. The zones identified so far appear to continue for at least 1,600m, representing a strong opportunity to follow them to the east and at depth.

The Company’s Aureus West deposit is located approximately 800m south of Aureus East and is interpreted to be its offset along a regional fault line. The Aureus West Project remains open in all directions and the Company is optimistic at being able to shrink the distance between the projects by drilling and defining new limbs of mineralization.

The MRE for Aureus East (“Project”) was completed in accordance with National Instrument 43-101 (“NI 43-101”) standards for disclosure and the CIM Definition Standards for Mineral Resources and Mineral Reserves (May 2014) and has an effective date of May 20, 2022.

A technical report is being prepared in accordance with NI-43-101 and will be available on the Company's website and SEDAR within 45 days of the effective date of the MRE. The MRE includes both pit constrained and underground constrained resources. The total combined resources include an Indicated mineral resource of 0.985 million tonnes (“Mt”) grading 5.14 grams/tonne (“g/t”) Au (162.7 koz Au contained) and an Inferred mineral resource of 4.185 Mt grading 2.88 g/t Au (387.6 koz Au contained).

Table 1. Aureus East Gold Deposit Mineral Resource Estimate

Type Cut-off (Au g/t)

Category

Tonnes

(‘000s)Au g/t

Contained Oz Au

(‘000s)Pit Constrained

0.44

Indicated

654

3.71

78.0

Inferred

2,557

1.79

147.2

Underground Constrained

2.40

Indicated

332

7.94

84.7

Inferred

1,628

4.59

240.4

Combined

0.44 / 2.40

Indicated

985

5.14

162.7

Inferred

4,185

2.88

387.6

- Mineral resources were prepared in accordance with the CIM Definition Standards for Mineral Resources and Mineral Reserves (MRMR) (2014) and CIM MRMR Best Practice Guidelines (2019).

- Mineral resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

- Mineral resources are not mineral reserves and do not have demonstrated economic viability.

- Mineral resource tonnages are rounded to the nearest 1,000. All figures are rounded to reflect the relative accuracy of the estimates and totals may not add correctly. Au ounces reported are troy ounces.

- Density was determined from measurements on 245 drill core samples. The density of background sediments was determined to be 2.72 t/m3; the density of the mineralized zones was determined to be 2.77 t/m3.

- Au g/t deposit grade was estimated using Inverse Distance Squared methods based on 1 m downhole assay composites. Capping was applied variably to each wireframe based on the distribution of assays; of the 39,831 assays, 243 were capped (0.6%). This was implemented to prevent the overestimation of grade. The parent model block size used was 2 m (x) by 2 m (y) by 2 m (z) with minimum sub-celling of 0.67 m (x) by 0.67 m (y) by variable (z). The model was regularized to 2 m (x) by 2 m (y) by 4 m (z) for pit optimization.

- Pit constrained mineral resources were defined within an optimized pit shell with average pit slope angles of 45° in rock and 25° in overburden, and a 13.1 strip ratio (waste material: mineralized material).

- Pit optimization parameters include: metal pricing at US$1,700/oz Au; exchange rate of C$1.33 /US$1.00; transportation and refinery charges of C$5.00/oz Au; 99.95% Au payable; 2.0% combined royalty charges; mining cost of C$5.25/t; processing plus general and administration cost of C$30.00/t processed; and a Au recovery of 96%.

- Pit constrained mineral resources are reported at a cut-off grade of 0.44 g/t Au within the 100% revenue factor optimized pit shell. The cut-off grade reflects the marginal cut-off grade used in pit optimization to define reasonable prospects for eventual economic extraction by open pit methods. Pit constrained mineral resources are reported from the model regularized to 2 m (x) by 2 m (y) by 4 m (z) to include must take blocks.

- Underground minable shape optimization parameters include: metal pricing at US$1,700/oz Au; exchange rate of C$1.33/US$1.00; transportation and refinery charges of C$5.00/oz Au; 99.95% Au payable; 2.0 % combined royalty charges; mining cost of C$125.00/t; processing plus general and administration cost of C$40.00/t processed; and a Au recovery of 97%.

- Underground constrained mineral resources are reported at a cut-off grade of 2.40 g/t Au. The cut-off grade reflects total operating costs to define reasonable prospects for eventual economic extraction by conventional underground mining methods. All material within minable shape optimization wireframes has been included in the mineral resource to include must take blocks.

- The MRE was prepared by Christian Ballard, P.Geo., of Nordmin Engineering Ltd., who is the Qualified Person as defined by NI 43-101 and is independent of Aurelius Minerals Inc. and Aureus Gold Inc.

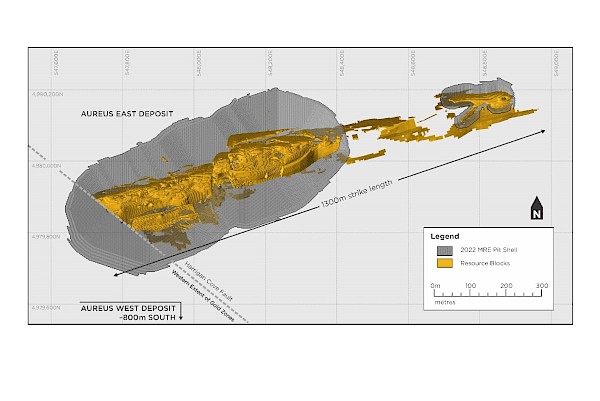

Figure 1: Plan View of Pit Constrained Resources at Aureus East

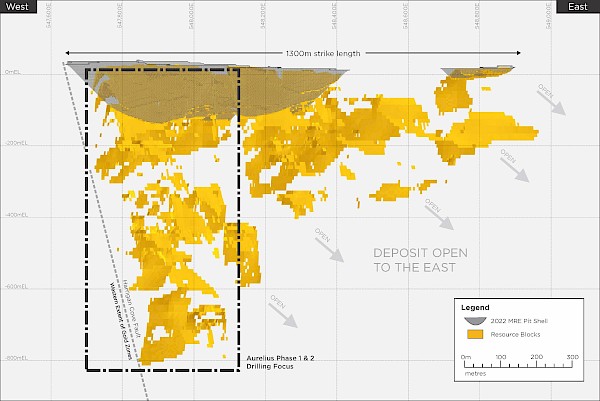

Figure 2: Long-section View of Underground Constrained Resources at Aureus East

Geology and Mineralization

The Aureus East deposit lies within the Meguma Terrane, the most southerly zone of the Canadian Appalachian province. The Meguma is historically associated with gold mineralization and mining in Nova Scotia, with a history of over 160 years of mining and exploration. The Meguma consists of a thick sequence of lower Paleozoic metasediments intruded by Devonian granitoid plutons. The metasediments are divided into two formations: the Goldenville Formation and the Halifax Formation.

The Aureus East deposit lies within an anticline hosted by the Goldenville Formation. The deposit occurs in a series of tight chevron-style fold-hosted quartz “saddles”. The hinge zone of the fold is typically a rounded arc-shaped structure of 5-10m and the “limbs” are typically more uniform and straight. These quartz horizons occur parallel to stratigraphy which consists of interbedded greywacke and argillite sequences. The deposit is regionally offset by the Harrigan Cove Fault on the Western margin, which has approximately 1.5km of strike-slip offset, and unknown (but significant) dip-slip displacement. The deposit itself also has lesser internal offsets (on the scale of 5-20m) with sinistral, east-side-down displacement. Four such faults have been incorporated into the resource model.

Gold mineralization is associated with the quartz saddles and limbs but is not restricted to only the quartz veins. In addition, numerous generations of quartz exist at the deposit, including parallel to the offset faulting as well as parallel to the fold compression (cleavage), which can also host gold mineralization. Resource modelling was domained through 230 wireframes designed to represent the quartz saddle/limb horizons hosting gold mineralization. These wireframes were separated into five fault blocks as dictated by the four offsetting faults within the deposit. Each wireframe was estimated individually. In addition, background wireframes were created for each fault block, which fully encompassed all mineralization wireframes within the fault block and were clipped to overburden and topography. An estimation was run on the background mineralization, that is, all the gold mineralization which was not able to be attributed to a mineralization wireframe. Wireframes which did not contain enough composites to be estimated, were returned to the background for estimation.

COVID-19 Precautions

Aurelius has developed and implemented compliant precautions and procedures that are in line with guidelines for the Province of Nova Scotia. Protocols were put in place and are updated where necessary to ensure the safety of our employees, contractors, and the communities in which we operate.

Qualified Person

Mr. Christian Ballard, P.Geo., of Nordmin Engineering Ltd., is the Qualified Person for this release and for the MRE it discloses, as defined by NI 43-101, and has reviewed and approved the technical information in this release.

About Aurelius

Aurelius is a well-positioned gold exploration company focused on advancing its recently acquired and renamed Aureus Gold Properties, including Aureus East and West, the Tangier Gold Project and the Forest Hill Gold Project located in Nova Scotia and described in detail in the Company’s press release of November 18, 2019.

Aurelius is also advancing two district-scale gold projects in the Abitibi Greenstone Belt in Ontario, Canada, one of the world’s most prolific mining districts; the 968-hectare Mikwam Property, in the Burntbush area on the Casa Berardi trend and the 12,425-hectare Lipton Property, on the Lower Detour Trend.

The Company’s management team is experienced in all facets of the mineral exploration and mining industry, and will be considering additional acquisitions of advanced staged opportunities in Nova Scotia, the Abitibi and other proven mining districts.

On Behalf of the Board

AURELIUS MINERALS INC.For further information please contact:

Aurelius Minerals Inc.

Mark N.J. Ashcroft, P.Eng.,

President and CEO

info@aureliusminerals.com

Tel.: (416) 304-9095

www.aureliusminerals.comNeither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Information

This news release contains “forward-looking information” under the provisions of applicable Canadian securities legislation, concerning the business, operations and financial performance and condition of Aurelius. All statements in this press release, other than statements of historical fact, are “forward-looking information” with respect to Aurelius within the meaning of applicable securities laws, including statements with respect to the Company’s planned drilling and exploration activities, the anticipated benefits of the Acquisition and the development of the Aureus Gold Properties, the future price of gold, the estimation of Mineral Resources, the realization of Mineral Resource estimates, success of exploration activities, permitting time lines, currency exchange rate fluctuations, requirements for additional capital, government regulation of mining operations, environmental risks, unanticipated reclamation expenses, title disputes or claims and limitations on insurance coverage. Generally, this forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" , "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" , "believes", or variations or comparable language of such words and phrases or statements that certain actions, events or results "may", "could", "would", "should", "might" or "will be taken", "occur" or "be achieved" or the negative connotation thereof. Forward-looking information is necessarily based upon a number of factors and assumptions that, if untrue, could cause the actual results, performances or achievements of Aurelius to be materially different from future results, performances or achievements expressed or implied by such statements. Such statements and information are based on numerous assumptions regarding present and future business strategies and the environment in which Aurelius will operate in the future, including the price of gold, anticipated costs and ability to achieve goals.

Certain important factors that could cause actual results, performances or achievements to differ materially from those in the forward-looking information include, among others, gold price volatility, mining operational and development risks, litigation risks, regulatory restrictions (including environmental regulatory restrictions and liability), changes in national and local government legislation, taxation, controls or regulations and/or change in the administration of laws, policies and practices, expropriation or nationalization of property and political or economic developments in Canada, delays, suspension and technical challenges associated with projects, higher prices for fuel, steel, power, labour and other consumables, currency fluctuations, the speculative nature of gold exploration, the global economic climate, dilution, share price volatility, competition, loss of key employees, additional funding requirements and defective title to mineral claims or property. Although Aurelius believes its expectations are based upon reasonable assumptions and has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the Mineral Resources will be converted to Mineral Reserves. Inferred Mineral Resources are based on limited drilling which suggests the greatest uncertainty for a resource estimate and that geological continuity is only implied. Additional drilling will be required to verify geological and mineralization continuity and it is reasonable that most of the Inferred Mineral resources could be upgraded to Indicated Mineral Resources. There is no certainty that a Preliminary Economic Assessment will be completed.

The Company provides forward-looking information for the purpose of conveying information about current expectations and plans relating to the future and readers are cautioned that such statements may not be appropriate for other purposes. By its nature, this information is subject to known and unknown risks, uncertainties and other important factors that may cause the actual results, level of activity, performance or achievements of Aurelius to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: risks related to difficulties in executing exploration programs at the Mikwam, Lipton and Aureus Gold Properties on the Company’s proposed schedules and within its cost and scheduling estimates, whether due to weather conditions, availability or interruption of power supply, mechanical equipment performance problems, natural disasters or pandemics in the areas where it operates, the integration of acquisition; risks related to current global financial conditions including market reaction to the coronavirus outbreak; competition within the industry; actual results of current exploration activities; environmental risks; changes in project parameters as plans continue to be refined; future price of gold; failure of plant, equipment or processes to operate as anticipated; mine development and operating risks; accidents, labour disputes and other risks of the mining industry; delays in obtaining approvals or financing; risks related to indebtedness and the service of such indebtedness, as well as those factors, risks and uncertainties identified and reported in Aurelius’ public filings under Aurelius’ SEDAR profile at www.sedar.com. Although Aurelius has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements are made as of the date hereof and, accordingly, are subject to change after such date. Aurelius disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise unless required by law.

Subscribe for UpdatesRegister to receive news via email from Aurelius Minerals Inc.

* Required Fields- Home

- Corporate

- Investors

- Projects

- News

- Contact

© 2025 Aurelius Minerals Inc.

All rights reserved. - Combined Indicated Mineral Resources of 162,700 oz Au, including;